How to trade buy / sell on SBI trading account/ sbiSmart website?

- After login to the sbismart website or app,

- Click on trade button on main navigation menu or a floating windows named ordered entry.

- Once your reached the Order entry,

- Select exchange NSE for large volume

- and the enter the company name it will automatically suggested

- there you will see stock price floating rate per seconds

- Select buy Product type (delivery /intraday/ t+5) select delivery for just buying. (know more on stock market terms)

- then select order type (limit /market) buying at current market price or specified price.

- when you select limit it will aks price (at which price you want to buy) at market price it auto selects current market price.

- Enter qty for of share be sure calculate share price and your available amount.

- After entering all the details you get confirm window.

- You may see the progress success/failure in order book, trading .

- you get the message once it sold /or bought.

How to Add Funds to SBI demat & Trading Account (lien / unlien)?

lien amount: transferred from savings.

collateral amount:(leverage) by broker based on your holdings 50% of holdings also called margin. you can’t withdraw it.

net lien amount: transferred from savings but not used. it gets saving account interest. you can withdraw it.

ledger balance: due to sbicap or you. if due to its automatically credits to saving account.

Withdraw money from trading account to saving account SBI

- click on mange besides the Limits button.

- then Select withdraw

- enter the amount available within limits

- you get request reference Id (amount will takes some working days.

How to unlien from sbi smart trading account?

unlike withdrawal unlien option gives instant transfer to SBI savings account.

How To view your holdings /stocks in SBI smart trading Account?.

Trading Account Vs demat Account

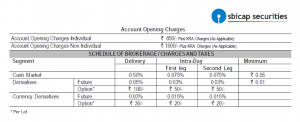

SBI trading Account charges

Account opening charge: Rs 850

Annual Maintenance Charge (AMC): Rs 500

Annual maintenance Charges

Demat account: 400/year

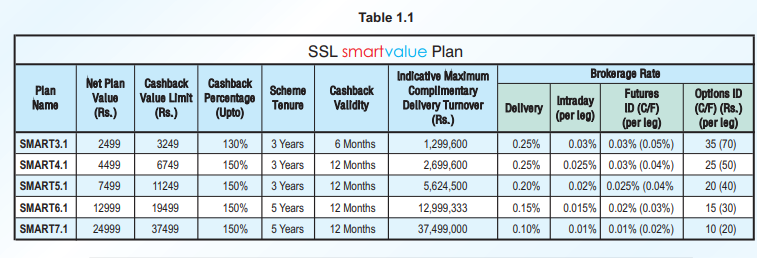

Trading Account: 500 / year or 3 years 2499 to 5 years 24999

Transaction based Commission / Brokerage charges

Equity: 0.5% or minimum Rs 10

Intraday 0.1%

Commodity options

Equity future options

equity options

- some traders intraday ended up paying higher brokerage charges than profits.

SBI Trading account types 3.1 vs 4.1 vs 5.1 vs 6.1vs 7.1

discount brokers vs full service broker (ft zerodha vs SBI trading account)

Discount brokers not deducts based on percentage of transaction but with a fixed price.

Ex: SBI/ICICI/ HDFC brokerage charges 0.5% on both sell & buy.

purchased worth of 10K stocks commission 0.5% = 50 but discount broker as zerodha charges 10 regardless of price of transaction.

note: intraday selling there is 0.001% charge by full service brokers and o% by discount brokers.

full service brokers trade for you upon your request. but discount you have to. more details will be here soon.

| features |

zerodha |

sbismart |

| trading account opening charges | 200 | 800 |

| Demat account annual charges | 300 | 350-400 |

| demat account opening charges | 0 | 0 |

| trading account annual maintenance charges | 0 | 0 |

| Minimum Brokerage Charges | 0.03% in Intraday and F&O | ₹0.05 for Cash, ₹0.01 Future |

| Equity Delivery Brokerage | free | 0.50% |

| Equity Intraday Brokerage | ₹20 per executed order or .03% whichever is lower | 0.05% |

cmp sbi caps charges

STATE BANK OF INDIA provides cash management services to Corporate Clients under the brand name SBI FAST

Narration TO TRANSFER CMP SBI CAPS

Debit 590.00

Ref/Cheque No. CMP00000000264900539AOC1219083

Login to SBI CAP and see ledger

SBI – By funds received for DP & Other Charges

CDSL

– CDSL AMC Demat bill for the period July-2020 to June-2021

590.0

Rs. 300 + 18% GST – For individuals, HUFs, partnership firms, and LLPs with zerodha

Rs. 400/- Rs 350/- for customers receiving statements by e-mail SBI AMC charges

400 +18% = 590

Life time free AMC Demat Offering brokers (Finvasia, iTradeOnline etc)

How to close SBI Trading & Demat Account?

Download the SBI Demat & Trading Account Closure Request Form

Visit any of the SBI branches near you.

online cdsl close account no online option as of now.