Market Order

selling or buying at current market price regardless of fluctuations.

CMP= Current Market Price.

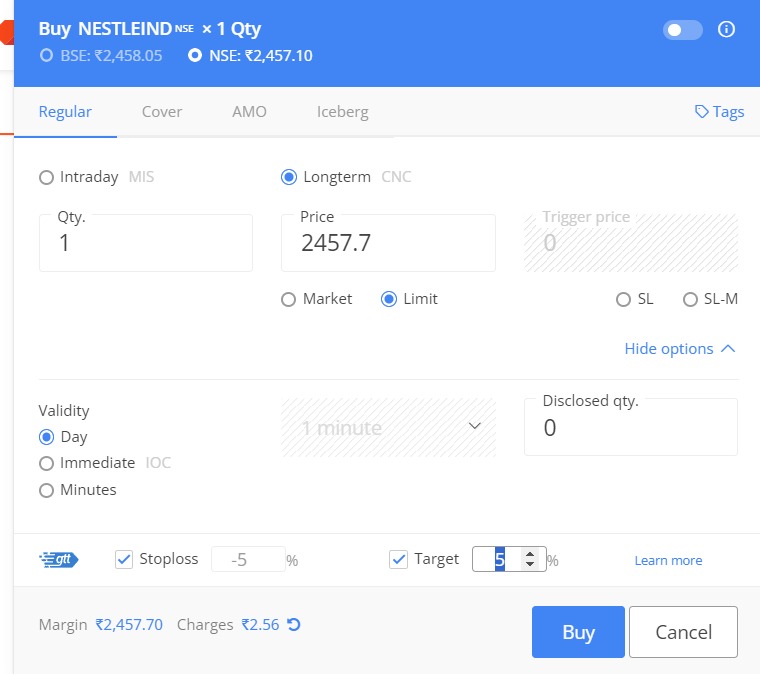

Limit order

Place order at exchange when the exact price reached.. execution lower than Stop loss order and STOP loss market order.

limiting your order by explicitly prescribing

Ex in a day/week/year.

Stock price goes up & down.

Higher men’s 100, lower means 59-70.

In a day price swinging around 90-100.

so I place a order to execute when the stock price goes down at 90.

Otherwards buying automatically when the price matches our prescribed limit.

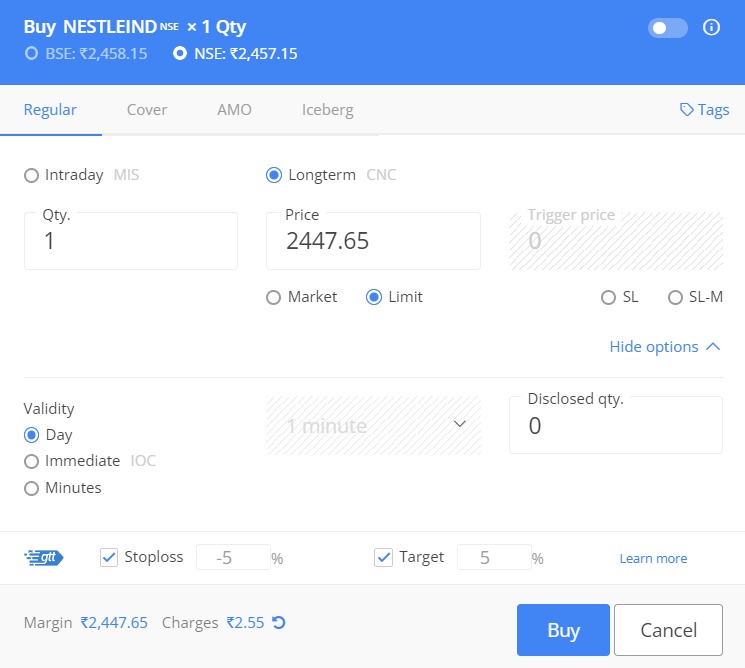

SL-L: stop loss limit order

Order to sent to exchange after trigger price match executed only when limit order price matches.

Intraday

buy at 100,

sell at 110(limit)

sell at 95(stop loss to avoid heavy loss)

Two inputs

Stock trading at 100

limit price: 95(execute when it reaches 95)

Stop loss(some times price may go down further 95-80)

to avoid selling ar low cost stop loss limit mention as 90.

Selling at fair price

Reducing risk by stop loss

Limit vs Stop loss order

Limit orders indicate that you want to buy or sell a security at a specified price rather than the market price.

trigger an order at a specific stop price and then carry out the transaction only if it can be completed at a certain limit price.

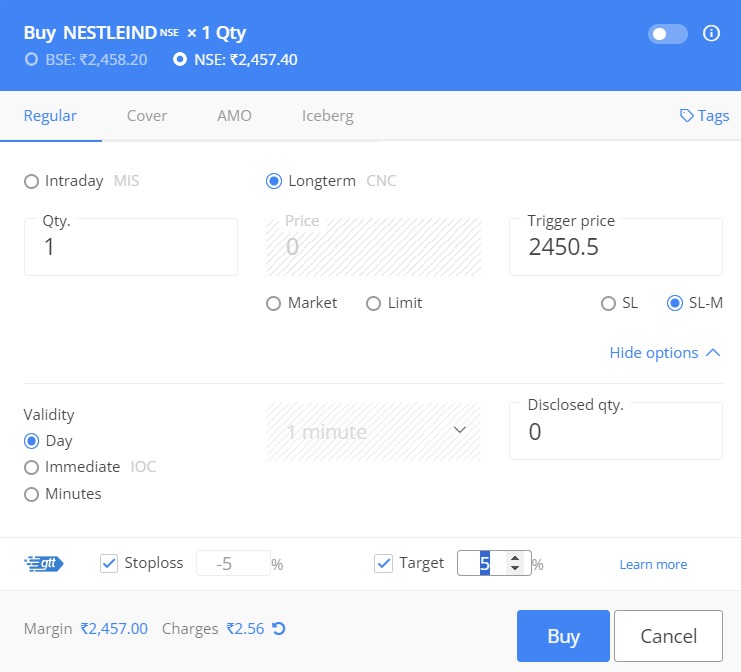

SL-M Stop loss market Order.

only 1 input

Stop loss (an lower value than market price if not executed at market order)

we sell a little bit lower than market price so it executes faster

Stock market price 100

Stop loss 95

SL-M vs SL-L

SL Order is a Stop Loss Limit Order in which you need to specify price as well as trigger price.

whereas SLM order is a Stop Loss Market Order wherein you need to specify only trigger Price (broker sent order to exhange).

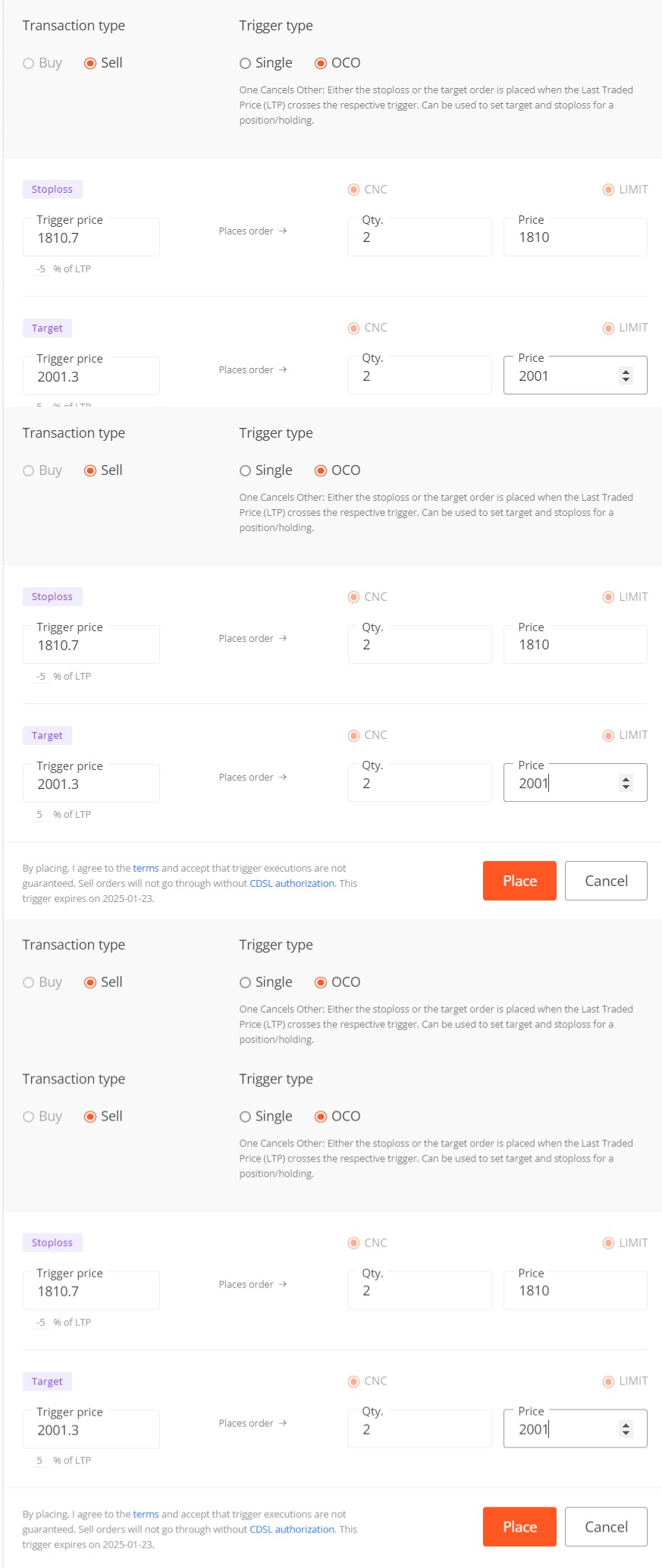

GTT Order Zeroda

he Good Till Triggered (GTT) feature is an order that stays active until the trigger condition is met. The validity of the trigger is one year.

GTT Zeordha sell order requires CDSL Pin for buying no need. more at zerodha

Zerodha GTT Order for portfolio holdings sell with 5% profit or loss within 1 year

Bracket order

3 orders to reduce loss

Entry, profit, stop.

Buy at 100

Sell at 101

Stop-loss 98

A BUY order is bracketed by a high-side sell limit order and a low-side sell stop order. A SELL order is bracketed by a high-side buy stop order and a low side buy limit order.

Cover Order

stop loss mandatory

a compulsory Stop Loss Order is required. In a Cover Order the buy/sell order can be a Limit/Market Order and is accompanied with a compulsory Stop Loss order,

AMO (After market Order):

After market order excuted between 4.30 to 9am.

You can place order any time but that excutes in market timing

IOC: instant order or cancel.

if you want to buy sell instant or cancel the order, then you can use this type.

Market watch

add your favourite stock to watch within trading account dashboard called as market watch.

Benefits:

Quickly see price drop &up.

one click demand & supply based on bid &ask price.

Bid &Ask price

How many people are waiting to buy a stock at what price ask price.

How many people’s are willing sell stock at prescribed price bid price.

You can see this feature in market watch if a stock.

higher demand means price increase.

Stock price in intraday mostly on demand and supply.

This technique useful to buy at lower and sell higher price instead of market order.

Position type intraday or delivery

Intraday automatically sold (by square off) within 1 day 9:30to 4:30pm

MIS Margin intraday square off (3.20PM)

CNC cash and carry (buy /sell no limit)

NRLM Normal(F&0, commodity, forex)

Delivery : buy or sell orders with cash no day limit

Swing trading: buy and wait for price increase usually days or weeks and sell at higher.

Position trading: Hold for more than weeks..