SEBI has banned entry loads w.e.f 1st August 2009. So, the Sale Price needs to be the same as NAV.

Exit Load (1%) have to be credited back to the scheme immediately

i. e. they are not available for the AMC to bear selling expenses. if redeemed within 1 year. no exit load for liquid funds. schemes has different periods in which they levy exit loads

Transaction Charges in case of regular

First-time mutual fund investor >> 150 Investor is other than first-time mutual fund investor 100 for above 10000 investments in a year paid to the distributor.

Initial Issue Expenses: Covers Fees of Trustees, AMC, R&T,Custodian, etc.

Not to be charged to scheme, it has to be born by the AMC.

commission and brokerage fee paid when shares, bonds and other securities are bought and sold.

Recurring Expenses :

Covers Selling Exps,Service tax,listing & depository fees and communication exps, Listing fee, Insurance premium, service tax, winding up costs, storage and handling cost of gold in case of Gold ETFs etc.

Brokerage and transaction cost may be capitalized to the extent of 0.12% for cash market transactions and 0.05% for derivative transactions respectively. More than this will come under the limit of Total Expense Ratio(TER).

Expenditure in excess of the prescribed total expense ratio limit (including brokerage and transaction cost, if any) shall be borne by the AMC or by the trustee or sponsors.

i) Investment management and advisory fees may charge additional by AMC.

Service tax

Mutual funds /AMCs may charge service tax on investment and advisory fee to the scheme in addition to the maximum limit of total expense allowed for the scheme

Service tax on expenses other than investment and advisory fee, if any, is to be borne by the scheme within the maximum limit of total expense allowed for the scheme.

Annual limits on recurring expenses (including management fees) for schemes other than index schemes :

Average Net Assets Per Week |

Equity |

Debt scheme |

| Up to Rs. 100 Cr | 2.5% | 2.25% |

| 100 to 300 Cr | 2.25% | 2% |

| 300 to 600 Cr | 2% | 1.75% |

| The excess over Rs 700 crore | 1.75% | 1.50% |

In case of debt funds, the above percentages shall be lesser by 0.25%.

Management fees cannot be charged by liquid schemes and other debt schemes on funds parked in short term deposits of commercial banks.

The expense limits for index schemes (including Exchange Traded Funds) is as follows:

Recurring expense limit (including management fees):1.50%

Management fees: 0.75%.

In case of a Fund of Funds scheme, the total expenses of the scheme including a weighted average of charges levied by the underlying schemes shall not exceed 2.50% of the daily net assets of the scheme.

If the new inflows from beyond top 30 cities are at least

30% of gross new inflows in the scheme

15% of the average assets under management (year to date) of the scheme, whichever is higher

the funds can charge additional expense of up to 30 basis points on daily net assets of the scheme.

In case inflows from beyond top 30 cities is less than the higher of

(a) or (b) above, additional total expense on daily net assets of the scheme shall be charged as follows:

Daily net assets x 30 basis points x New inflows from beyond top 30 cities / 365 X Higher of (a) or (b) above

The additional TER on account of inflows from beyond top 30 cities so charged shall be clawed back in case the same is redeemed within a period of 1 year from the date of investment.

additional expenses,

Mutual funds are allowed to charge any additional expenses, incurred under the various heads of permitted recurring expenses and investment and advisory fees, but not exceeding 0.05% of daily net assets of the scheme.

However, the schemes wherein exit load is not levied / not applicable, the above mentioned additional expenses shall not be charged to the schemes.

AMCs need to disclose the scheme-wise, and date-wise TER on a daily basis, of all schemes under a separate head – “Total Expense Ratio of Mutual Fund Schemes” on their website and on the AMFI website in a downloadable spreadsheet format

Any changes in the base TER compared with the previous base TER charged to a scheme, must be communicated to the investors through email or SMS at least three working days prior to effecting such change.

Eg. If TER is to be effective from January 8, 2018 (Monday), then notice shall be given latest by January 2, 2018, considering at least 3 working days prior to effective date.

The changes in TER shall also be placed before the Trustees on quarterly basis along with the rationale.

GST

AMC(s) can charge GST to the schemes, but within the limits prescribed by SEBI

GST on fees paid on investment management and advisory fees can be charged to the scheme in addition to the overall limits specified earlier, but for other than investment and advisory fees it must be within the prescribed TER limits

GST on exit load, if any, shall be deducted from the exit load and the net amount shall be credited to the scheme.

GST on brokerage and transaction cost paid for execution of trade, if any, shall be within the limit of TER

The mutual fund trust is exempt from tax but the trustee company will however pay tax in the normal course on its profits.

For Investors In Equity / Equity Oriented Schemes Of Mutual Fund

Purchase of units of equity oriented mutual fund NIL

Sale of units of equity oriented mutual fund 0.001% Payable By Seller.

STT is not applicable on transactions in debt or debt-oriented mutual fund (including liquid fund) units.

Dividend Distribution Tax (DDT)

The Dividend Distribution Tax (DDT) is paid by the AMC (for both Equity and Debt schemes), hence the dividends are exempt from tax in the hands of the unitholders.

Equity oriented Scheme: 10%

Money Market or Liquid Schemes /Debt Schemes 25%

(other than Infrastructure Debt Fund)

Infrastructure Debt Fund 25% for nri 5%

12% Surcharge(individuals earning a net taxable salary of more than Rs 1 crore)

90+ 4% cess

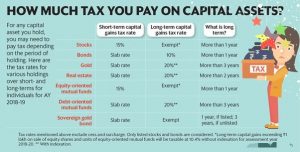

capital gain tax

Equity and Equity Oriented Scheme*

STCG 15 % + Surcharge and Cess

LTCG LTCG < Rs l Lakh = NIL LTCG > = Rs l Lakh = 10%

+ Surcharge and Cess

Debt and Debt Oriented Scheme

STCG (i.e. as per the tax slab of the investor)

LTCG 20% with indexation

For Long term capital gain/loss investment in equity mutual fund should be one year and above compared to investment in debt Mutual Fund to be 3 years above.

Where STT is not paid for Equity Schemes, the taxation is similar to debt-oriented schemes.

Dividends in the hands of the investor is tax free.

There is no TDS on the dividend distribution or re-purchase proceeds to resident investors.

set off losses

In the normal course, one would expect that a loss in one head of income can be adjusted (“set off”) against gains in another head of income.

A few key provisions here are:

Capital loss, short term or long term, cannot be set off against any other head of income (e.g. salaries)

Short term capital loss is to be set off against short term capital gain or long term capital gain

Long term capital loss can only be set off against long term capital gain

Since long term capital gains arising out of equity-oriented mutual fund units are exempt from tax, long term capital loss arising out of such transactions is not available for set-off.

Investments in mutual fund units are exempt from Wealth Tax.

Mutual funds vs stocks bonds vs Bonds

Bonds: gives defined at interest (no volatility) for the year by the issuer (Corporate, government bonds)just like FD.

Mutual funds direct vs regular plans

Regular Plan: High charges with Mutual fund distributor ideas. The expense ratio of 2.5% (1.5% commission on your every SIP goes to the distributor)

Direct Plan: LOw charges direct link to Mutual fund company. 1%

NAV if Direct plan 16% but regular 15% or 14.5% (because of Distributor commission)

how to buy direct mutual fund online / Offline?

Well, how to choose direct plans: Direct from a company You have to check the expense ration to decide whether it direct or Regular Plan.

offline

1.visit Mutual Fund company (mostly banks).

locate using here

https://www.amfiindia.com/investor-corner/online-center/locate-amc-branches.aspx

ask them a direct plan they may trick you to take regular plan please aware of expense ratio.

online

http://www.karvycomputershare.com/

https://www.camsonline.com/

http://www.mfuonline.com/ (

NOTE: No Advice Support on investment if you choose Direct. But Regular Plan costs so much in the long term.

Entry load: there is no entry load as of now.

Switch Price

charges when changing schemes

Distribution and Service Fee

marketing, printing, mailing of the AMC

Account Fee

account if they do not meet the minimum balance

Management Fee

paying your Fund Manager

Recurring Charge

for maintaining the portfolio, advising, marketing and other expenses on a daily/quarterly/annual basis.

Exit Load

range of 0.25% to 4% if the investor sells a price within the lock-in period.

Transaction charges

Above 10,000 SIP 150INR New, 100 INR as existing investor charges on Monthly investments.

lump sum investment

Expense ratio: calculated on a daily basis after deducting charges on expenses.

NAV (Net Asset Value): this actual value of your stock after deducting above charges. and your return of an investment calculated after deducting all charges.

STOCK Trading Charges

SIP Investment Monthly:

| SIP Stock | per trade | turnover |

| Broker | 0.5% | |

| Securities Transaction Tax | 0.1% | |

| Stamp duty | 0.01% | |

| SEBI turnover | 0.0002% | |

| exchange transaction charges | 0.003% | |

| GST on Broker charges | ||

| GST on Sebi turnover | ||

| AMC Fees |

12,000.00, 32.55 INR

STT: 0.1% of 12K then

Discount brokers: Zerodha, Trade Smart,

flat fee (Rs 10 intraday or Rs 20 per delivery trading

no advice

Full-Service brokers: ICICI, SBI, Kotak

(0.01% intraday or 0.50% delivery trading)

advises

Borker charge: 0.05% 0.50% on turnover

Security transaction tax,

intraday charges only 1 side. for delivery trading charges both sides

Delivery 0.1% intraday 0.025%

GST 18% on Broker +transaction charges

stamp duty (for state Govt), ex: 0.01% on long, 0.002 on intraday applies on every trade charged on the total amount (turnover).

transaction charges (stock exchange), on Turn over

NSE 0.00325%

BSE 0.00275%

SEBI turnover charges,

charge is 0.0002% both side & same for intraday & delivery + GST

depository participant (Demat) charges

flat between Rs 10 to 35 for delivery, not for intraday

annual maintenance fee is Rs. 200/- plus service tax.

Rs 50,000 to 2 lakh rupees, Rs 100.

capital gain tax

sell a stock before 1 year of buying, STCG flat 15% of the capital gain or profit. if you sell after 1-year capital gain tax (LTCG) 10%. no LTCG below 1 lakh.

| Particulars | Amount (Rs.) |

| Total turnover | 50,000 |

| Brokerage – 30 bps (30 paise for every Rs. 100) | 150 |

| Stamped duty at 0.01% | 5 |

| Securities transaction tax on delivery: 0.1% on turnover | 50 |

| transaction charges: 0.0035% on turnover | 1.75 |

| Service tax: 14%* on brokerage | 21 |

| Service tax: 14%* on turn over/transaction charges | 0.25 |

| Swachh Bharat Cess: 0.50 % on brokerage and turn over/transaction charges | 0.86 |

| Krishi Kalyan Cess: 0.50 % on brokerage and turn over/transaction charges | 0.86 |

| Total charges (including brokerage) | 229.71 |

| Total payable (in case of purchases) | 50,229.71 |

| Total receivable (in case of sale) | 49,770.30 |

229.71/50000*100=0.46%* (numbers may not correct)

ETF / Index Funds VS Active traded Mutual Funds

ETF buying parts of a whole bunch of companies. But unlike a stock, which focuses on one company,

while mutual funds traded actively (Buy sell charges and High expense ratio)

Disclaimer: Some numbers change year to year.